Invest in Storage Units: An Overview to Passive Income

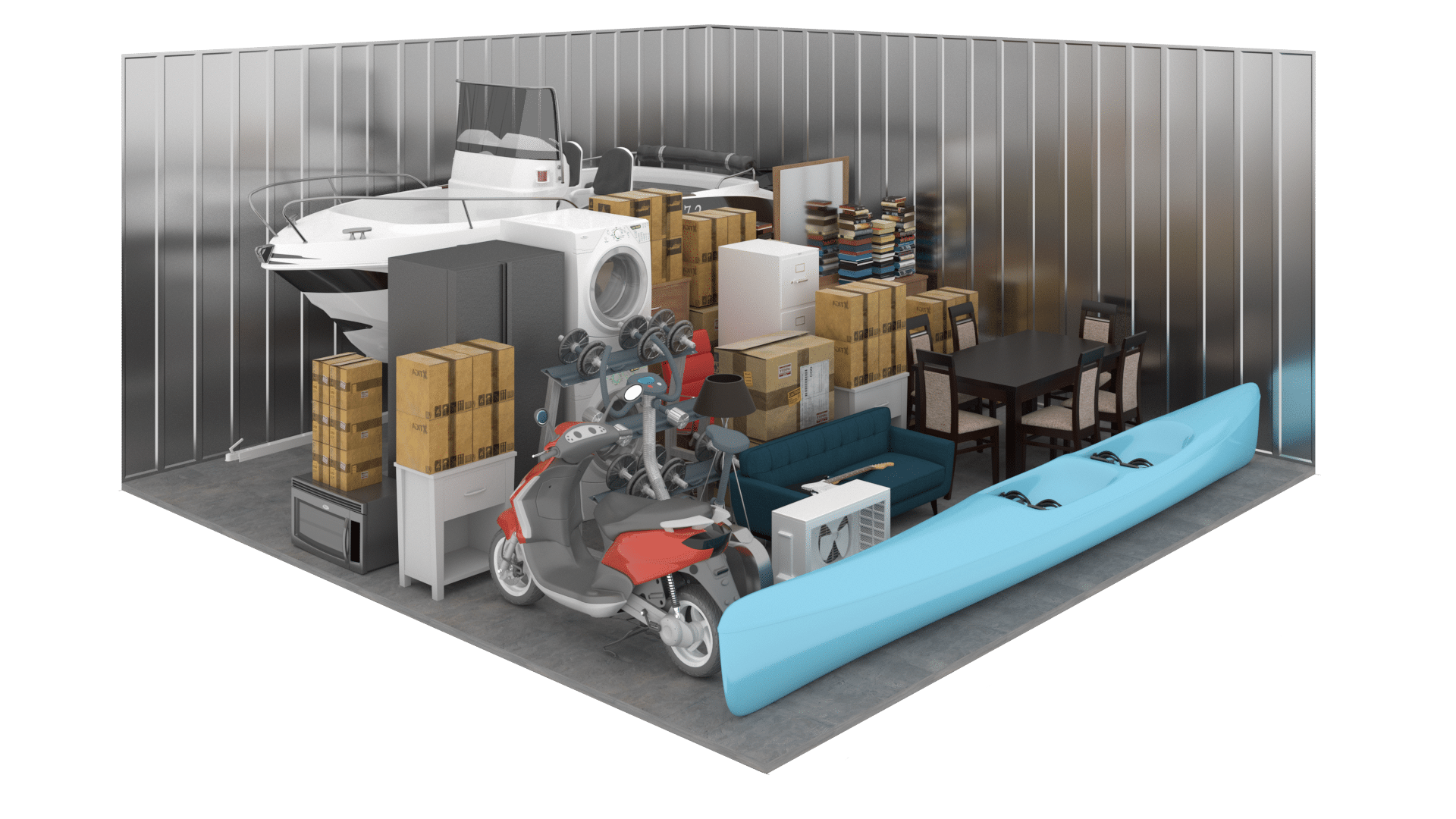

As the real estate market is evolving, shrewd property investors seeking new opportunities for creating passive income. One such opportunity that has risen in popularity over the past few years is putting money into self-storage facilities. Due to the increase in consumer demand and the growing need for more space, storage facilities have become a common option for individuals looking to organize their homes or keep items during life transitions.

Putting money into self-storage facilities offers a distinct combination of stability and the possibility of profit. Unlike residential or commercial properties, storage spaces tend to require limited maintenance and management effort, making them an appealing alternative for investors looking for a low-effort investment. In this article, we will explore the basics of self-storage investment, emphasizing their advantages and offering guidance on how to maximize your investment potential.

Understanding Unit Storage Investment

Putting money in self-storage facilities has accrued traction as an appealing option for those seeking to diversify their realty holdings. This commitment allows investors to create steady income with fairly low upkeep compared to traditional rental units. With a increasing requirement for storage solutions, notably in metropolitan and suburban areas, investing in storage units can be a financially rewarding endeavor for shrewd investors.

One of the key pros of storage unit investments is their capacity to offer a steady cash flow. Unlike housing units, keeping goods usually entails more compact leases, allowing owners to adjust prices more regularly. This versatility can lead to higher earnings, particularly in markets with increasing demands resulting from factors like city expansion, reducing space, or altering ways of life. Additionally, running a self-storage facility often requires decreased overhead costs, as the units typically do not demand extensive repairs or maintenance.

Comprehending the market dynamics is important for effective investment in storage units. Conducting thorough analysis on local demographics, rivals, and economic trends can help find the most suitable places for investing. Moreover, building relationships with fellow investors and professionals in the sector can offer insightful knowledge and help stakeholders make smart choices. With the correct method and an eye for possibility, storage unit investing can present a trustworthy way to create assets over time.

Advantages of Investing in Self-Storage Facilities

Putting Money in self-storage facilities offers a steady source of passive income with relatively low management responsibilities. In contrast to conventional rental properties, self-storage units typically require less hands-on involvement from the owner. Most clients sign short-term leases, which allows for greater flexibility and the potential for regular rent increases without the complications associated with long-term tenant agreements. This dynamic creates a consistent revenue stream with minimal ongoing effort, appealing to busy property owners.

Another major advantage is the steady demand for storage spaces. As people relocate often, reduce their living space, or seek to organize their belongings, the need for self-storage spaces continues to increase. This demand is particularly robust in cities where living spaces are smaller, leading to an increased reliance on external storage solutions. Moreover, companies often require storage for surplus inventory or supplies, providing an additional client base. This variety helps protect against market fluctuations.

Lastly, self-storage facilities typically have lower operational costs compared to other real estate investments. Properties such as multi-family homes or commercial properties require considerable maintenance, utilities, and management personnel. Storage facilities generally need minimal amenities, and many functions can be automated. This efficiency can lead to increased profit margins and a more attractive return on investment, making self-storage spaces a smart choice for those looking to build their wealth steadily.

Tips for Effective Management

Successful management of storage units requires regular care to detail. Start by ensuring storage units airway heights with your tenants. Make sure to provide tenants with important information regarding access hours, payment procedures, and any rules governing the facility. This openness can help foster a trusting relationship and reduce misunderstandings. Regularly check in with tenants to verify their needs are met and that they are comfortable using the storage space.

Routine maintenance and security are also crucial for successful management. Conduct routine inspections of the property to guarantee that everything is in good condition, from the storage units themselves to the surrounding areas. Invest in proper security measures such as lighting, surveillance cameras, and controlled entry systems to protect your tenants' belongings. A well-maintained and secure facility will attract new customers and keep existing ones satisfied.

Finally, consider implementing a robust marketing strategy to increase occupancy rates. Utilize online platforms, social media, and local advertising to reach potential tenants. Offering promotions during busy seasons can also attract more customers. By actively marketing your storage units and maintaining high standards for management, you can create a sustainable investment.